Rent in Austin is too high.... for businesses.

Commercial land use and lease reforms are just as critical to Austin's future as residential ones.

"Keep Austin Weird," once a rallying cry for preserving the city's unique character, now feels like a distant memory. Glass and steel towers dominate the skyline, and $17 cocktails have become the norm at once-affordable watering holes. Though the desire to support local businesses persists, a sense of defeatism prevails as beloved mainstays shutter their doors, unable to cope with the soaring costs of doing business.

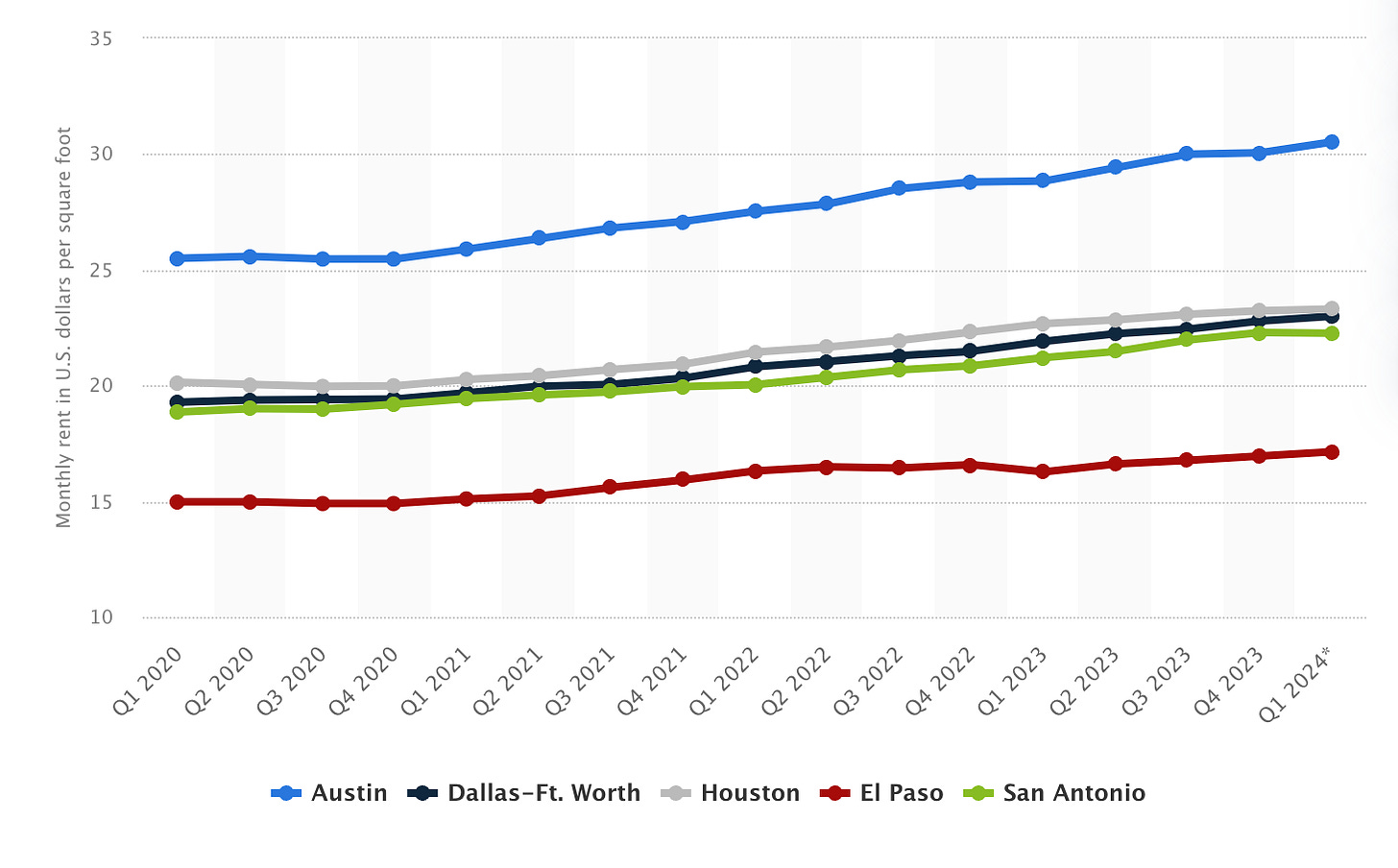

Commercial rent increases are universally cited by small business owners as a driving factor in this decline. These increases have been steep and relentless. From 2020 to 2024, average rent for retail spaces in Austin rose from about $26 to over $30 per square foot, even as apartment rents cooled due to increased supply. Desirable areas with heavy foot traffic like South Congress Avenue have seen even more dramatic increases, with rents exceeding $100 per square foot, rivaling prices in the most expensive U.S. markets like New York City.

Austin’s retail rental market has drastically outpaced our peer cities in Texas. Rents in other major Texas metros, while rising, are far below our sky-high prices.

https://www.statista.com/statistics/1307017/asking-rent-shopping-center-real-estate-united-states/

The unaffordability of commercial space has profoundly impacted Austin's culture. The dream of opening a small bookstore or corner cafe is often shattered by the financial realities of a booming metro area. Instead, investment pours into luxury shops and boutiques that can afford the outrageous fixed costs by charging exorbitant prices. Many entrepreneurs who helped shape Austin's culture simply cannot compete for the limited and expensive retail spaces.

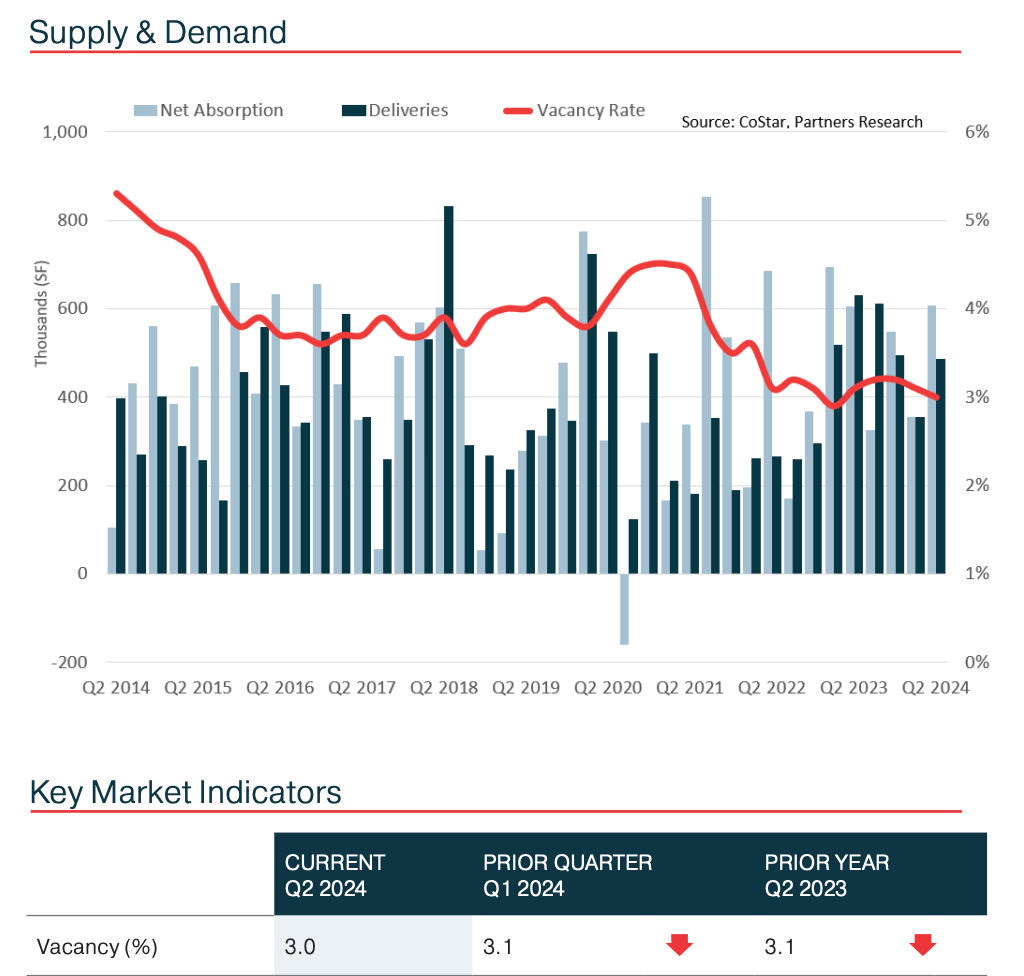

Despite high costs, businesses are snapping up available spaces; the commercial vacancy rate is near an all-time low, having fallen by nearly two-thirds in the last decade. This low vacancy rate translates to a fiercely competitive market where landlords hold the upper hand. With few alternatives, small businesses are often forced to accept rent increases of 50% or more upon renewal, trapped in a "pay up or die" scenario, without the protections that residential renters enjoy.

Our key metric, vacancy rate, has been falling significantly over the last decade, currently near a multidecaal low. Source: https://partnersrealestate.com/wp-content/uploads/2024/04/Q2_2024_Austin_Retail_QuarterlyReport.pdf

While Austin has led the country in building new housing, we've failed to keep pace with the need for new retail spaces. We've created a perfect storm: retail spaces are restricted in most of the city, permitting and compliance are nightmarishly complex, and landlords are reaping the benefits of this artificially constrained market by offloading their investment risks onto unprotected renters.

To recapture the laid-back vibe of "Old Austin," we must lower costs not just for residents but also for the small businesses that define the city's ethos of independence and quirkiness. We need to accept the reality of supply and demand and shape the market to achieve desired outcomes, rather than catering to entrenched landowning interests.

Failure to do this has had real consequences for our most beloved local businesses, who can find themselves trapped in properties that are falling apart with no other options. Recently, Nixta Taqueria faced a crisis when their building's outdated electrical system required a complete overhaul. The cost of repairs and the complex permitting process threatened to shut down the business. Moving to another location was simply not feasible. While community outcry led to the city waiving some fees, the core issue remained unaddressed: Nixta had been rented a space with unsafe wiring, and the burden of repairs and the risks associated fell almost entirely on them, not the landlord.

A similar story unfolded with Taco-Mex, East Austin’s favorite hole-in-the-wall taco dispensary, which attempted to expand to a second location in 2019. Upon moving in, they discovered unusable plumbing that required extensive and costly repairs. Unable to overcome the financial strain, both the new and original Taco-Mex locations eventually closed. Today, Birdie’s occupies this space, paying off its new sewer system one $40 plate of minute steak at a time.

These stories highlight the stark contrast between residential and commercial leases. Residential renters are guaranteed functioning facilities, while commercial renters have no such protections. This creates a perverse incentive for landlords to profit from their tenants' struggles. A commercial space is almost always rented "as is" with no provision for the critical building systems like electrical, water, plumbing or air conditioning. While some aspect of an as-is system makes sense (every commercial buildout is different, after all) it should not be legal for a landowner to bait and switch their tenants into making the investments they refuse to.

Austin needs to build drastically more small commercial spaces in currently residential-only areas and reform its rules regarding commercial leases. Allowing small corner shops and services throughout the city would create opportunities for entrepreneurs and revitalize neighborhoods. This would require an overhaul of our land use code, which forbids commercial structures in over 90% of our city.

Tokyo offers a compelling example of what could be possible. Despite being the world's largest metropolitan area, rents for small commercial spaces are remarkably low. This is because shops can be located almost anywhere, even in homes. In contrast, Austin's zoning laws isolate businesses to car-dependent districts, limiting accessibility and driving up costs. A small artisan knife maker is basically relegated to a home garage-based business in Austin, simply due to the cost of a retail space, but in Tokyo can easily have a public-facing shop thanks to flexible land use rules and low costs. We can emulate these successes by making small but substantive changes to our regulatory framework to allow small local businesses into our neighborhoods and protecting them from predatory landlords in our existing retail stock.

We have an advantage in addressing this: we've already seen signs of success in tackling a similar situation with our housing crisis. Increasing the supply of commercial spaces, along with reforms to provide more protections for renters, will lead to a healthier market with more favorable lease terms for businesses, just as it has begun to do in the residential market, where rents have fallen in the last two years.

If we want to "Keep Austin Weird", we must make it possible for weird people and weird businesses to thrive. That means lowering costs, reducing regulatory burden, fixing our permitting process and welcoming small, unique businesses throughout the city, even in our cloistered residential enclaves. Bold leadership is needed to achieve this. We must shift our focus from preserving Austin's appearance to preserving the people and businesses that define its culture.

Austinites must connect the dots between the $17 cocktail and the captive market that created it, enriching landlords at the expense of entrepreneurs. If we fail to act, we'll find ourselves in the same bland corporate landscape that blankets other Texas cities. We can have a different future, but we cannot expect it to happen on its own. Weirdness is a choice. Let’s make the right one.